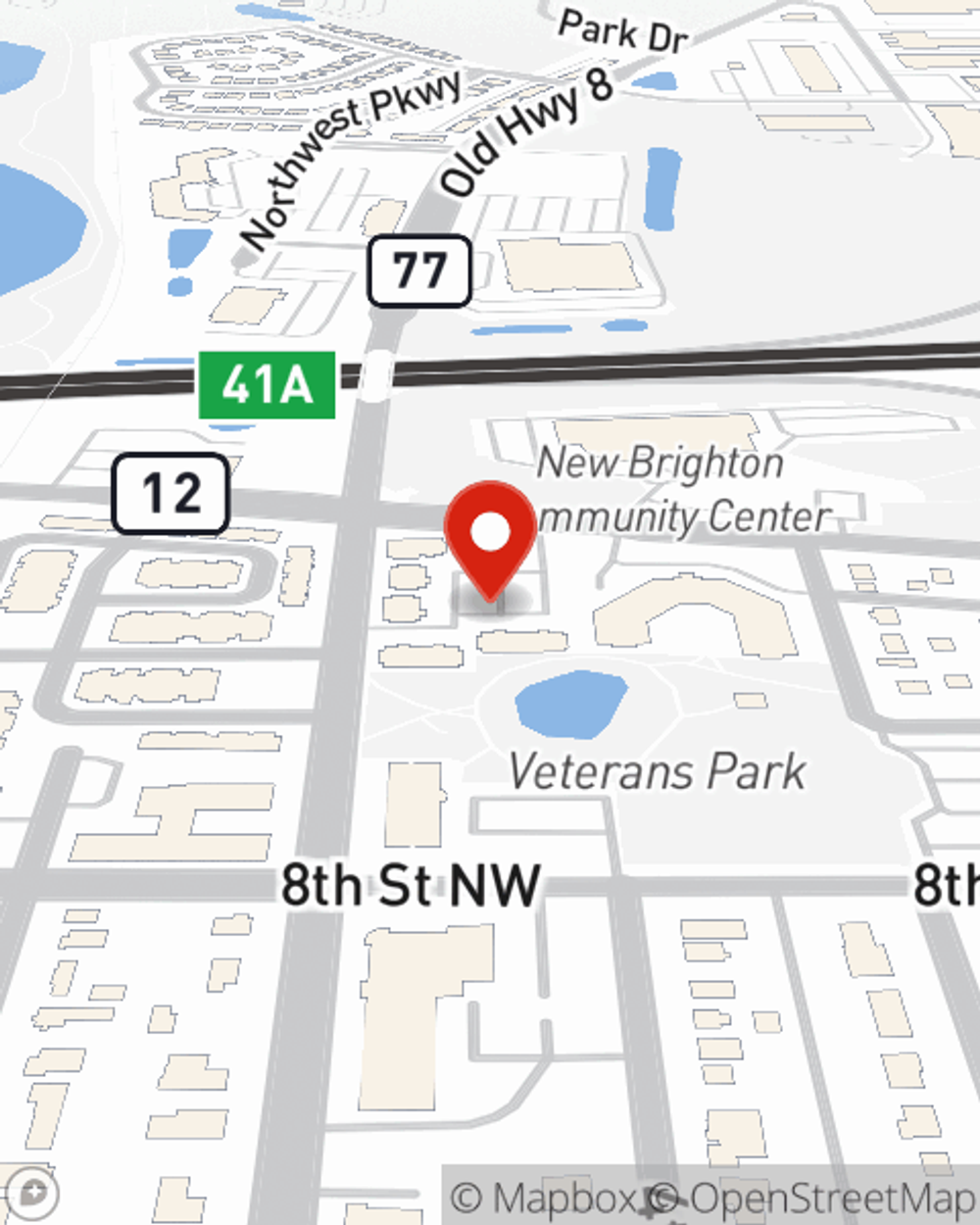

Homeowners Insurance in and around New Brighton

Looking for homeowners insurance in New Brighton?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

One of the most important precautions you can take for your favorite people is to get homeowners insurance through State Farm. This way you can laugh and play knowing that your home is protected.

Looking for homeowners insurance in New Brighton?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Homeowners Insurance You Can Trust

Tyler Hanson will help you feel right at home by getting you set up with secure insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect prized possessions like your grandfather clock.

Don’t let fears about your home make you unsettled! Visit State Farm Agent Tyler Hanson today and find out how you can benefit from State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Tyler at (651) 488-7810 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

Tyler Hanson

State Farm® Insurance AgentSimple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.